What Are the Benefits of Good Credit?

Jan 11, 2024 By Triston Martin

Introduction

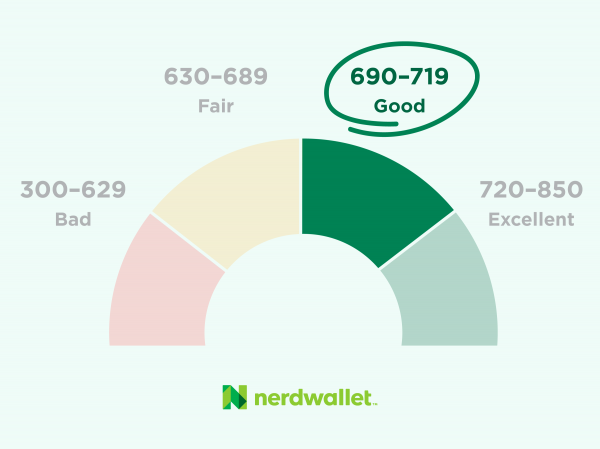

Do you know the benefits of a good credit score? One's credit score is determined by the information in one's credit report. The procedures utilized to determine a credit score are different. The FICO score is the most popular and widely utilized credit score. The score assigned to a potential borrower can fall anywhere from 300 to 850. Credit scores can be ranked as excellent, good, or low. Those with an excellent credit history can choose from the first three categories of borrowers. Excellent credit, according to Experian, is a score of 800 or better. Borrowers with excellent credit scores of 740 or above, while those with an average credit score are between 670 and 739. Lenders tend to be more willing to extend credit to borrowers with FICO ratings of 670 or above.

Benefits Of a Good Credit Score

What are the benefits of having good credit? Your credit score is a significant factor in most lenders' choices, so building and having a solid credit history is essential. If your credit score is low, you should work to raise it before applying for a loan or a rental. You can demonstrate to potential lenders that you can be trusted to pay back loans promptly if you have an established credit history. That can put them at ease, knowing that you are someone they should want to do business with again. Potential landlords, employers, and insurance in many jurisdictions can all benefit from seeing a good credit history. What follows is an examination of the advantages that can accrue to you due to good credit.

Avoid Security Deposits on Utilities

A high credit score may also be necessary to connect your utility services. In most cases, turning on your utilities won't be too much of a headache if you have a solid credit score. However, if you have bad credit, you may need to deposit or get a co-signer to legally commit to paying your payment if you don't.

More Negotiating Power

An excellent credit rating gives you bargaining power when negotiating the terms of a new loan or credit card. If you need more leverage in negotiations, you can consider the various favorable offers you've received from other businesses due to your excellent credit standing. Let's say, nevertheless, that your credit rating is less than stellar. If that happens, your loan conditions won't be negotiable, and you won't be able to choose from any alternative credit options.

Better Car Insurance Rates

Add auto insurers to the list of businesses that will use a low credit score against you. Insurers utilize data from your credit report and other records to estimate your insurance risk. It's common to practice charging those with poor credit histories more for insurance. A higher credit score means reduced insurance premiums, even for similarly risky drivers.

Higher Credit Limits

You can borrow more money from lenders if you have a low DTI and a high credit score. This is because they can see that you are financially stable and trustworthy. A greater credit limit is something you can apply for when opening a new account or you can ask for when using an existing credit card or line of credit.

Bragging Rights

Because of these advantages, having a high credit score is an accomplishment to be proud of, especially if you had to put in a lot of effort. If you've never had to deal with a low credit score, you must do all you can to keep it that way. One can quickly become behind in their payments after missing only a few.

Easier Approval for Rental Properties

You still need a decent credit score even if you never intend to buy a property. Landlords often check your credit when you apply for a property, and only some tenants know this. A landlord will be more likely to approve a tenant with a decent credit score since tenants with a history of on-time payments are more desirable than those with multiple delinquencies. If you don't, you might have to fork over a larger security deposit, settle for a shorter lease period, or be completely shut out of the rental market.

Conclusion

Now you know the benefits of good credit. A borrower's eligibility for various forms of credit heavily depends on their credit score. The majority of traditional lenders only consider lending to customers with stellar credit. As a result, only applicants with credit scores of 670 and above will typically be considered for financing. In general, loan approval rates for these applicants are higher. Loan terms are more likely favorable for them than applicants with lower credit scores. The quality of your credit score affects nearly every aspect of your financial life, from your ability to obtain loans and mortgages to renting an apartment.

Top Peer to Peer Payment Apps

Because of the growing number of phones on the market today, peer-to-peer payments applications account for a significant portion of the digital payments industry. P2P applications, in their most basic form, allow for the frictionless movement of cash between two users. If you have ever divided a bill at a restaurant and paid the difference using a digital platform, you have certainly taken part in a peer-to-peer payment.

Dec 28, 2023 Triston Martin

Bank Guarantee vs Letter of Credit: Understanding the Differences

Confused between Bank Guarantee (BG) and Letter of Credit (LC)? Read on to understand them, their features, and when to use them to secure transactions

Jan 17, 2024 Susan Kelly

Comparing Briefly: Target-Date Funds vs. S and P 500 Indexing

The ease of use provided by target-date funds has been a significant factor in their rapid increase in popularity among 401(k) retirement plans. Compared to S and P 500 Index Funds, they have a few disadvantages, even though they could appear to be the most obvious option for most workers.

Feb 20, 2024 Triston Martin

Tax Benefits of Owning a Home

Becoming a homeowner can have many financial advantages. Learn about the tax deductions and other cost savings of owning property.

Jan 27, 2024 Susan Kelly

Top 6 Excellent Investment Courses That May Be Taken Online For Free

Vanguard provides age-appropriate investment education via its website. The Morningstar Investment Classroom offers in-depth, topic-specific lessons. NAPFA offers a monthly free webinar series covering tax preparation, investing and financial planning.

Feb 23, 2024 Triston Martin

Do You Need This No-Fee Uber Visa Card In 2023

The Uber Visa card provides loyal customers with valuable rewards that can be used on future rides and other services. Bonuses may be earned on all Uber services, from Uber Eats to JUMP. If you like to dine out and travel, you will appreciate this credit card that does not charge annual fees

Jan 29, 2024 Triston Martin