How Long Does it Take for a Check to Clear?

Feb 15, 2024 By Triston Martin

With the rise of credit & debit cards and the increasing digitalization of the financial sector, fewer and fewer people are opting to write checks. However, inspections are still in use, so knowing the typical clearing time is essential. Check deposits don't immediately release funds. Your money balance may suggest that, but that's not necessarily true. So, how long it takes for a check to clear and other possible explanations for its delay in the processing are discussed below.

The Reason Why Your Check Has Been Delayed

The bank & account category determines whether a check is held. If this happens, you risk the statement being rejected or incurring additional costs if you attempt to use the money before it is legally available.

Check Clearing Time

It may take some time for the funds to appear in your bank or savings account after a check has cleared. The holding periods for appraisals are governed by policy at most major banks. A bank often holds a check to guarantee the funds are ready for transmission. It typically takes three to five working days for a bank to receive funds after a check has been written. How long your check is held depends on how much it is, how much money is in the account, and even how well you know your bank. If it's been more than five days, do not be afraid to call your bank and ask how your check is doing.

What Causes Processing Delays?

There are several potential causes for processing delays. The most prevalent explanations are below.

- One: It's a unique deposit. If the check is for an unusually big amount, originates from a new customer, or originates from a foreign bank, the financial institution may choose to flag it.

- Second, the payee's account has insufficient money. When a bank receives a check that has problems, such as insufficient funds, they often resend it to the payer's bank. Because of this, the processing time is lengthened.

- Three: New accounts. A bank may delay depositing your cheque if you have just established a checking or savings account.

- Number Four: Money Placed in an ATM. The bank has the right to freeze any check deposited by an automated teller machine or mobile banking application until it can validate the deposit.

Whenever you deposit a check, the bank will provide you with a receipt detailing the transaction and the availability date of the money. Keep this in case there are any problems with your account balance, and you need to make a quick adjustment. Although it is rare, banks do have the option to ignore the holding period. If you're a longtime, trusted client or if the check hold is too lengthy, your bank may intercede. To resolve this, though, you'll need to physically visit the bank and also find out how long it takes a check to clear to avoid panic.

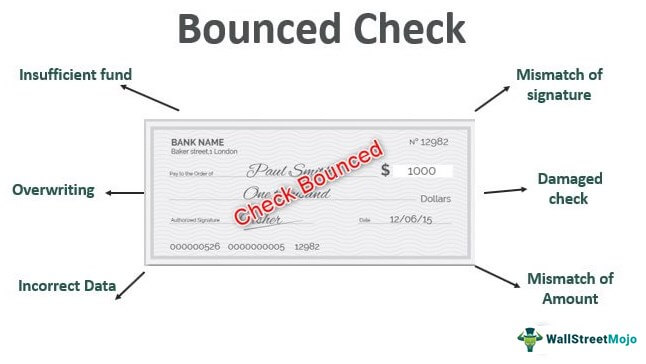

Possibility of Check-Bouncing

If there are red flags, the check may be returned unpaid. If you have faith in the individual or organization that was responsible for writing the check, you should feel comfortable depositing the check and using the money immediately. If you don't know or trust the check's author, though, it's best to hold off on spending the money in case there are issues with the transaction. Please keep in mind that if the check you have deposited prematurely is returned unpaid, you, as the payee, may be liable for reimbursing the bank for the amount of the check. Overdraft costs are rather high since the bank is covering the negative balance. If you don't pay it back, your current balance on the credit card will become negative. For a brief time, you will be unable to utilize your bank card or make checks, and you will incur expensive fines.

Detecting If a Check Has Cleared

Prior to writing a check, it's a good idea to familiarize yourself with the bank's depositing regulations. Check-clearing times are often mentioned in such policies. Normally, signed checks are good for six months. Of course, it's preferable to deposit checks as immediately as possible, but if that's not feasible, don't sweat it. In the absence of unforeseen circumstances, your bank must comply with the law and make money accessible to you within a fair amount of time.

Suspicious Checks: What to Do

Losses of nearly $29,000,000 were reported to the Federal Trade Commission this year due to fraudulent checks that were sent to more than 28,000 individuals. To avoid this, try these measures:

Avoid Checks

If you don't know the check's author or the validity of the money, this is the most secure method.

Talk to the Bank

Try calling the payee's bank to find out if the money is real. If you suspect that the check is counterfeit, you should independently verify the bank's customer care number. And if the case is otherwise, find out how long it takes to clear a check.

Give It a Month

It may take many weeks before you learn whether or not a check was valid. If you have any suspicion that the cheque is fake, do not deposit it. If you have previously done so, you should wait at least one month before spending the money again. In order to prevent late fines or additional debt, give yourself some time to verify that the check is legitimate.

Refinancing a VA Loan

You have two options for refinancing a VA loan: Lower the interest rate with a VA streamline refinance or extract equity with a cash-out refi.

Nov 12, 2023 Susan Kelly

Reasons a home buyer should ask for a loan condition

Provided something goes wrong during the loan approval or home inspection processes, the buyer will be able to cancel the purchase agreement if the contract contains a loan contingency clause. If a buyer is unsure if they will be able to secure a house loan, they should make sure a loan contingency, also known as a mortgage or financing contingency, is in their contract.

Dec 18, 2023 Susan Kelly

Online Brokers for Free Stock Trading

Choosing the right online broker for free stock trading requires careful consideration of several factors. It's essential to review the charges, the trading platform, the security measures, and the investment options offered by the broker. By comparing your options and making an informed decision, you can find the right online broker to help you reach your investment goals

Oct 05, 2023 Triston Martin

Fha Vs. Conventional Home Loans: Choose The Best Home Loan

Are you confused about which one to choose: FHA vs Conventional home loans? This comparison guide will help you choose the best option.

Jan 25, 2024 Triston Martin

How to Calculate the Home Mortgage Interest Deduction (HMID)

Most homeowners don't fully grasp the tax benefits of homeownership, and the mortgage interest deduction is a major part of that. It has become so well-known that many would-be homeowners are already convinced of its merits before conducting the necessary calculations to establish whether or not they qualify

Jan 26, 2024 Susan Kelly

Unaffiliated Investments

Investments in assets that are not directly controlled by the insurance company or any other firms in which the insurance company has a majority ownership stake. Investments not associated with a company might take the form of stocks, mortgages, property, or other assets.

Nov 12, 2023 Triston Martin