Saving Money And Making A Budget For An Apartment

Nov 21, 2023 By Susan Kelly

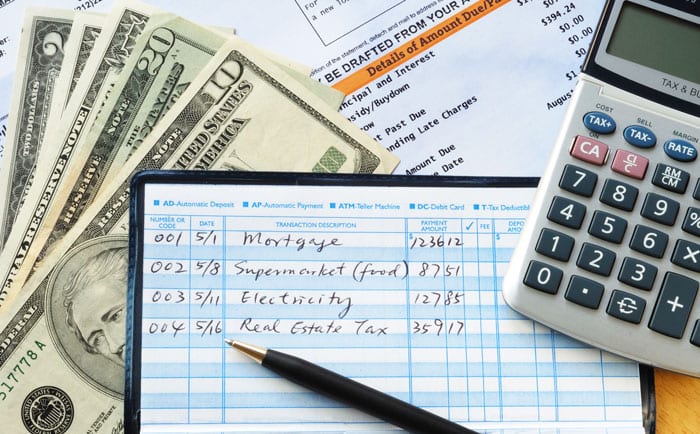

An effective strategy to keep tabs on your money and build a solid savings cushion is to create a budget. Chances are you stumbled onto this page because you're looking for a new place to call home.

Rent, moving costs, and a security deposit are just some of the apartment-related costs that may be saved with some planning and disciplined spending. I realize how hectic relocating may be and how much you have to do. It would be best to read on to learn more about ways to save money and make ends meet as you start this new chapter of your life.

What Exactly Is Budgeting?

When you develop a budget, you may assess your financial situation and decide if you have enough money to buy anything you desire or need. Saving on rent or other apartment-related expenses may be accomplished more quickly if you keep to a budget. People set financial goals for various reasons, like saving for retirement or making a full security deposit on a new apartment. Regardless, you need a budget if you want to know how much rent you can pay.

A Budget's Determining Factors

Your Salary

Identifying sources of revenue is step one in budgeting. If you don't know already, ask your company for a pay stub report. While regular money from a job is the most obvious source of cash flow, other sources of income that can be factored in include:

- Interest

- Dividends

- Stock/bond capital gains

You may get reliable information about your income by contacting your banking and investment institutions and requesting reports on your cash flows. Gift money isn't considered income because it doesn't come from a stable source, but it can speed up the process of reaching your objective. How about the birthday check from grandma? Did she give you a beautiful one for $75? Please put it in a savings account and enjoy the compound interest it earns.

Monthly Bills

Knowing what you spend money on each month might give you an idea of how likely you are to achieve your goals. Checking your previous bank and credit card statements will give you a good idea of your spending habits.

It would help if you looked back six months to a year to get a more precise sum. Don't forget to include miscellaneous costs like renter's insurance. If you want to know how much you've spent over a specific period, tally up your bills and divide the total by the number of months in your budget. The amount represents a rough mean of costs.

Reachable Objective

After calculating your typical monthly outlay, you can proceed to your next step: goal-setting. You should evaluate your goals and the time available to complete them. Determine a realistic target by subtracting your typical monthly outgoings from your total income.

A firm or industry "in the green" is financially successful. Regarding renting, someone with a positive net income is in a solid position to begin a savings program. If you're "in the red," which indicates you have a deficit, you don't have any spare cash to put away in the bank.

Expenditure

If a renter has financial difficulties, they should evaluate where the money is going. Numerous options exist for doing what needs to be done while cutting costs. Start by setting aside money for shopping and fun activities. The average monthly expenditure for eating at restaurants in the United States is $232, as reported by The Simple Dollar. If you can reduce this cost, you'll have $116 more to spend toward your rent-related objective.

Time Invested In Recording

Keeping a log of your purchases is the best approach to keep tabs on your finances. Home budget tracking is a breeze with the help of Excel spreadsheets, or you may use one of the several user-friendly mobile budgeting applications available. Even if you've adjusted your spending patterns, if you're still falling short of your financial goal, you may need to reevaluate the goal and make more cuts to your budget.

What Should My Apartment Budget Look Like?

The 50/30/20 Rule is a helpful budgeting approach that may be used for the cost of renting an apartment. This Rule suggests allocating 30% of your income toward necessities and 70% to desires and savings. The guideline states that half of your salary can be spent on necessities like food and housing. The difference between a need and a want is that a need is necessary for survival. You can spend up to 30% of your salary on luxuries like new clothing and concerts.

The Chase Sapphire Reserve: Navigating the Annual Fee Landscape

Is the Chase Sapphire Reserve annual fee worth it? Discover if it is justified by exploring its perks, rewards, and robust security features.

Feb 06, 2024 Triston Martin

Is It Reasonable To Have A Credit Score Of 766?

A person's credit score is a crucial indicator of their financial well-being. A person's creditworthiness is indicated by a three-digit number, often 300 to 850. A good credit score shows that a person is reliable with financial obligations and will repay loans and other commitments on time.

Feb 13, 2024 Triston Martin

Bank Guarantee vs Letter of Credit: Understanding the Differences

Confused between Bank Guarantee (BG) and Letter of Credit (LC)? Read on to understand them, their features, and when to use them to secure transactions

Jan 17, 2024 Susan Kelly

The Top Providers of Pet Insurance

Veterinary treatment can be quite costly, as anybody who has ever brought a sick or wounded pet to the vet knows. Having a cash cushion to fall back on in times like these may be beneficial. Also, it applies to circumstances in which you shouldn't have to choose between your family's financial well-being and your pet's health. Below you'll find best pet insurance providers UK.

Oct 31, 2023 Triston Martin

Varo vs Chime: The Ultimate Comparison for a Better Banking Experience

An in-depth comparison of Varo and Chime, two leading mobile banking platforms. The review covers features, user experiences, and key takeaways to help you choose the best option.

Dec 30, 2023 Susan Kelly

How do market orders and limit orders differ, and which one is preferable to use?

When traders need to enter or exit a position immediately, regardless of price, they use market orders. A limit order, on the other hand, tells a broker to buy or sell a stock only at a certain price. In contrast to a limit order, a market order ensures that the broker will execute the stock trade.

Nov 12, 2023 Triston Martin