Is It Reasonable To Have A Credit Score Of 766?

Feb 13, 2024 By Triston Martin

A 766 credit score is excellent, somewhere in the middle of the "very good" and "good" ranges. Credit scores are numerical numbers between 300 and 850 given to people based on their credit history and financial conduct. A higher credit score indicates that the person is less of a credit risk to financial institutions. A credit score of 766 shows a good credit history that includes being on time with payments, using credit sparingly, and having various credit accounts. This may improve their chances of securing a loan or line of credit and lowering their interest rate. Credit scores are one element banks, and other financial institutions use to determine whether or not to provide credit. Other criteria may include the applicant's salary, debt-to-income ratio, and length of work.

What Is A Credit Score?

A person's creditworthiness is measured by a three-digit number known as a credit score 766. A person's score is determined using data from their credit report. The credit report details the borrower's financial situation, including their payment history, credit usage, and accounts.

Types Of Credit Scores

Each kind of credit score has its unique scoring system. FICO and VantageScore are the two most used credit scoring schemes. Most lenders use FICO. However, specific lenders and credit score of 766 bureaus use VantageScore. Scores may be higher on the FICO and VantageScore scales, with higher scores indicating more vital credit.

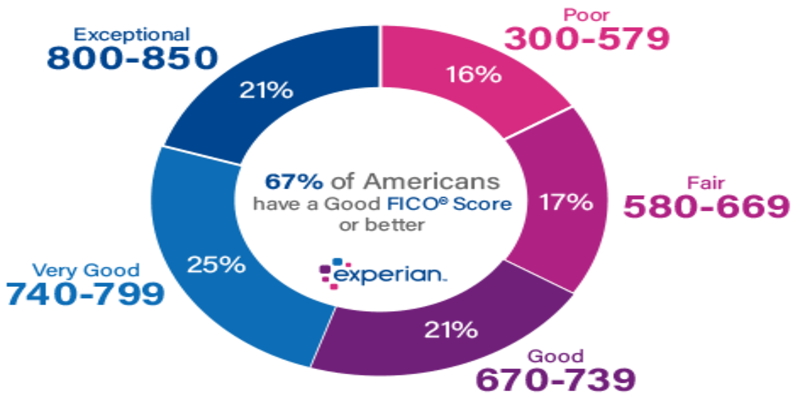

Fico Credit Score Ranges

From 300 to 850, FICO credit ratings fall into the following five groups:

- Excellent: 800–850

- Excellent: 740-799

- Positive: 670-739

- Moderate: 580-669

- Bad: 300-579

- Vintage

Score Credit Score Ranges

Credit scores using VantageScore vary from 300 to 850 and are broken down into six groups, as shown below:

- Superb: between 781 and 850

- Excellent: 661-780

- Acceptable: 601–660

- Moderate: 500–600

- Dismal: 300-499

Credit Score Of 766

A score of 766 or above indicates excellent credit. It is in the ideal range for VantageScore credit ratings and the acceptable content for FICO credit scores. A credit score of 766 means that you are a reliable borrower and will pay your bills on time. If your credit score is 766 or higher, you may qualify for better interest rates or other terms on loans, credit cards, as well as other forms or consumer credit.

Factors That Affect Credit Score

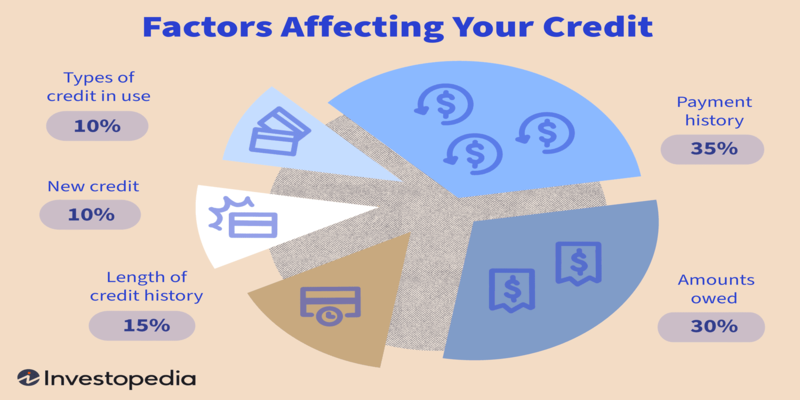

To keep a decent credit score, it is essential to understand the many aspects that contribute to it. A credit score is affected by the following:

Payment History

A person's payment history is the most influential factor in their credit score. As it is responsible for 35% of a person's FICO credit score, it is the most crucial factor in determining their creditworthiness. Late payments, missed payments, or defaulting on payments may significantly impact a person's credit score.

Credit Utilization

A person's credit score is also affected by how often and how much they use credit. Thirty per cent of a person's FICO credit score is based on their utilization rate, which is the ratio of their outstanding balances to their total available credit. When a person uses a lot of their available credit, it might lower their credit score.

Length of Credit History

Of the many elements that determine a person's credit score, the length of their credit history ranks high. The time a person makes credit payments is reflected in this 15% of their FICO score. The duration of their credit history may directly influence a person's credit score.

Conclusion

A credit score of 766 is excellent and may open several doors for borrowers, including lower interest rates and more favourable lending arrangements. Lenders and creditors don't base their choices on credit scores; they also look at things like a borrower's salary, length of work, and debt load. Individuals should be aware of their credit history and how it may affect their capacity to receive credit in the future. They should take steps to preserve excellent credit habits and responsible financial conduct. Improving one's credit score requires several factors, including regular monitoring of one's credit report and taking action to rectify any inaccuracies or unfavourable entries.

Learn and Understand: How to Refinance a Personal Loan?

Consider a personal loan refinance to consolidate multiple unsecured debts into manageable payments. There are times when doing this directly with your original lender is the best option, but there are also times when it may be preferable to work with a different lender. Refinancing could help you save money or reduce your monthly payments.

Dec 28, 2023 Susan Kelly

You Must Understand How To Invest In Copper

Copper is considered one of the most valuable metals, and indeed the copper industry consists of businesses engaged in its discovery, extraction, development, and production. Copper's widespread usage in the building and remodeling industries and in consumer electronics, industrial equipment, transportation, and power production and transmission makes the metal's demand highly sensitive to economic fluctuations. Copper investors might choose from several different strategies. Copper bullion bars, including coins, copper futures, and exchange-traded funds (ETFs) that invest in copper and some other precious metals, including copper stocks, are all ways for investors to get their hands on the metal.

Feb 02, 2024 Triston Martin

The Top Providers of Pet Insurance

Veterinary treatment can be quite costly, as anybody who has ever brought a sick or wounded pet to the vet knows. Having a cash cushion to fall back on in times like these may be beneficial. Also, it applies to circumstances in which you shouldn't have to choose between your family's financial well-being and your pet's health. Below you'll find best pet insurance providers UK.

Oct 31, 2023 Triston Martin

Saving Money And Making A Budget For An Apartment

After an interminable amount of time spent looking, you've discovered the ideal place to call home. It's affordable, elegant, and has plenty of room to move around. But when the first month's invoices come in, you may be taken aback to see a higher total amount owed than you had anticipated. Costs beyond just rent include things like utilities and upkeep.

Nov 21, 2023 Susan Kelly

Top 6 Excellent Investment Courses That May Be Taken Online For Free

Vanguard provides age-appropriate investment education via its website. The Morningstar Investment Classroom offers in-depth, topic-specific lessons. NAPFA offers a monthly free webinar series covering tax preparation, investing and financial planning.

Feb 23, 2024 Triston Martin

Highest Paying Positions At Major Banks

Working for large banks may lead to a prosperous and secure financial future. Many positions exist in the financial industry, each calling for a unique mix of knowledge and experience. Investment banking, wealth management, risk management, compliance officer, quantitative analysis, investment analyst, and credit analyst are just a few high-paying positions discussed in this article. These positions are vital to the bank's success and may lead to promising careers.

Nov 17, 2023 Triston Martin