Important Considerations How to Understand a Balance Sheet

Jan 19, 2024 By Triston Martin

The balance sheet details a company's assets and liabilities as well as its equity and debt. The capacity to make payouts to shareholders, service debt, and cover operational expenses shortly may all be gauged using this data. Liabilities + Equity = Assets is the fundamental accounting equation used to analyze a balance sheet. Analysts need to be aware that not all assets and liabilities are assessed similarly. Some things are valued at their fair market worth, while others are valued at a percentage of their historical cost. The analysis will go more smoothly if you grasp the measurement challenges. Unsurprisingly, revenue and cost recognition problems that show up on the income statement are intimately connected to the measurement problems on the balance sheet.

Essential Tips How To Understand Balance Sheet

How To Read A Balance Sheet

The book value, also known as shareholders' equity, is a crucial indicator of a company's financial health and is determined by the balance sheet. We'll break down the details of the asset section, the liability section, and the shareholder equity portion of accounting records to show you what information is included in each area. To understand a company's value and financial flexibility, investors should review the company's balance sheet. The solutions to queries like these may be found by learning how to comprehend a balance sheet.

- How much money is sitting in the bank for the corporation to use for expansion?

- How much of the company's assets consist of physical things like buildings and equipment?

- Can we get a breakdown of the company's debt?

- Can you tell me what the firm is worth?

Basics Of Balance Sheets

You might think of your balance sheet (or financial statement) as a summary of your business's financial health at a given period. Here, you can see a full accounting of your assets, debts, and equity as of a specific date. A banking system can be made on any date that coincides with the conclusion of the reporting period, like a 30 days, quarter, or year.

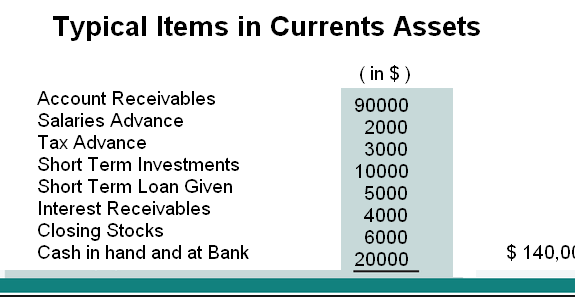

Recognize Current Assets

Assets that can be transformed into money within a year are considered current assets. These are examples of existing assets. Cash consists of checks, hard currency, and open bank accounts; accounts receivable refers to short-term payment transactions owed to your business, such as invoice number your clients will pay soon; inventory refers to finished, in-progress, and raw goods to product-based firms; and cash refers to all three.

Analyze Long-Term Assets

Assets that are not readily converted to cash and won't be turned into cash within a year are non-current assets. Both physical and immaterial assets might be considered non-current.

- Tangible Assets

You may include things like printers and laptops in this category of property and equipment.

- Intangible Assets

Comprise intangible assets like trademarks, trade names, and patents.

Depreciation determines the value of most long-lived assets on a balance sheet.

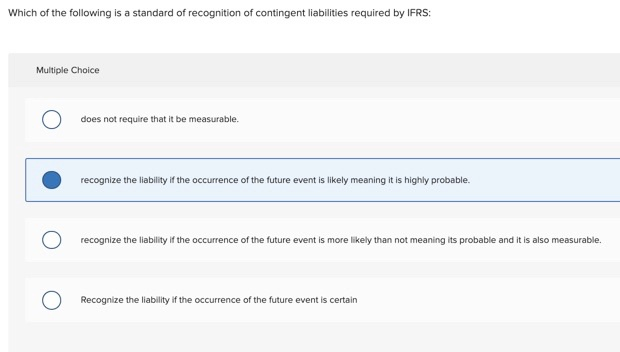

Examine Liabilities

The next step in deciphering a balance sheet is learning about the company's obligations. All of a company's monetary debts to other parties are considered liabilities. There are two distinct kinds of debt.

- Current Liabilities

Accounts payable, salaries, and interest on long-term debt all fall under short-term obligations, all of which are due within a year.

- Long-Term Liabilities

Liabilities due longer than a year after the balance sheet date include debts, loans, and other financial commitments.

Recognize Shareholder Equity

The balance sheet section devoted to shareholders' equity is next in importance. Equity in the hands of stockholders represents a company's overall value. The cash an owner puts into the business at the outset is included. On the balance sheet, retained profits represent the portion of a company's annual net profit that was reinvested into operations.

Conclusion

You may have a deeper understanding of your financial condition and make more educated choices for your practice if you are familiar with the various financial papers and the information included. This is the first of many articles to help you understand your medical business's financial accounts. Here, we examine your balance sheet first. The financial jargon may be beyond the comprehension of particular practitioners. As you are reading this article, you may want to look up the meanings of any financial terminology used. Although many in the medical field find financial matters boring, educating yourself and keeping an eye on your business's financial health is essential.

Detailed Guide to Homeownership for Single Parents

Special home loans for single parents help them stabilise homes, achieve dreams of owning a home, and create a brighter family future.

Jan 26, 2024 Triston Martin

Bank Guarantee vs Letter of Credit: Understanding the Differences

Confused between Bank Guarantee (BG) and Letter of Credit (LC)? Read on to understand them, their features, and when to use them to secure transactions

Jan 17, 2024 Susan Kelly

What Are the Benefits of Good Credit?

If a borrower has good credit, it means they have a high credit score and are not a significant risk to lenders. Credit bureaus are the ones that hand out the scores. Lenders use credit scores to make underwriting decisions and disclose information found in a consumer's credit report.

Jan 11, 2024 Triston Martin

Refinancing a VA Loan

You have two options for refinancing a VA loan: Lower the interest rate with a VA streamline refinance or extract equity with a cash-out refi.

Nov 12, 2023 Susan Kelly

Reasons a home buyer should ask for a loan condition

Provided something goes wrong during the loan approval or home inspection processes, the buyer will be able to cancel the purchase agreement if the contract contains a loan contingency clause. If a buyer is unsure if they will be able to secure a house loan, they should make sure a loan contingency, also known as a mortgage or financing contingency, is in their contract.

Dec 18, 2023 Susan Kelly

Highest Paying Positions At Major Banks

Working for large banks may lead to a prosperous and secure financial future. Many positions exist in the financial industry, each calling for a unique mix of knowledge and experience. Investment banking, wealth management, risk management, compliance officer, quantitative analysis, investment analyst, and credit analyst are just a few high-paying positions discussed in this article. These positions are vital to the bank's success and may lead to promising careers.

Nov 17, 2023 Triston Martin