An Ultimate Guide: What Is the HUD-1 Settlement Statement?

Feb 25, 2024 By Susan Kelly

Introduction

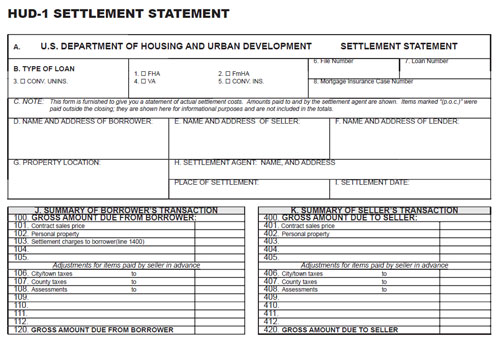

The HUD-1 form must be used in all real estate settlements in the United States involving federal mortgage loans per the Real Estate Settlement Procedures Act (RESPA). The law stipulated that this procedure was in this fashion. A HUD-1 statement would have been given to you if you applied for a mortgage on or before October 3, 2015. Borrowers applying for the vast majority of mortgage loans after October 2015 were given a new document called the "closing disclosure." The TILA RESPA Integrated Disclosures, or TRID for short, altered the processes for processing mortgages and providing important information, which prompted the shift. HUD-1 forms are typically used in mortgage refinancing and reverse mortgage transactions. They were first created in the United States.

Understanding a HUD-1 Form

The money you'll have to shell out to close the deal is broken out on the HUD-1. According to federal regulations, the form must be used as a standard real estate settlement for all mortgage refinancing and reverse mortgage transactions. Borrowers must be provided with a copy of the HUD-1 at least one day before the settlement, even if the numbers can be changed until the parties are seated at the closing table. This action is required to stay on the right side of the law. Before signing, most buyers and sellers seek advice from a third party, such as a lawyer, settlement agent, or real estate agent. Buyers are still called "borrowers" on the HUD-1 form, even if no loan is involved.

What's Included in a HUD-1 Form?

The HUD-1's reverse, or verso, is the side you should examine first. The borrower's fees are shown in the left column, while the fees the seller will pay are listed in the right column. The borrower is liable for the costs of the mortgage, such as the origination charge, discount points, credit report fee, appraisal cost, and flood certification price. Not only that, but there may also be prepaid interest payments, insurance premiums, taxes, title insurance premiums (both lender and owner), and closing agency fees to consider.

A seller's itemised list may include information regarding the real estate commission, any credits to the buyer that were contractually agreed upon, and the payoff of the buyer's mortgage. Sometimes a buyer's costs will be higher than the selling party's itemised expenditures, but that's not always the case. Numbers on the HUD-1 back page (verso) are added up, and the totals are written on the HUD-1 front page (recto). Amounts owed by the buyer to the seller and the seller to the buyer are shown at the bottom of the agreement's first page.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA mandated that a copy of the HUD-1 be delivered to the borrower at least one day before the settlement. It's possible, though unlikely that we'll keep getting submissions right up to the last few hours of the contest. Many parties consulted with their real estate and settlement agents, but most buyers and sellers did so independently. The more eyes that looked at it, the more likely it was that flaws would be spotted, or so the theory went.

Mortgages That Require a HUD-1 Statement

While the HUD-1 form was once standard in real estate transactions, acquiring a typical home is no longer required. If you are dealing with a mortgage today and you receive a HUD-1 form, you are most certainly dealing with one of the following types of mortgages:

Reverse Mortgage

If you are a senior citizen getting a reverse mortgage to access the equity in your home, you will receive a HUD-1 settlement statement.

Refinance

The HUD-1 form may be provided to you in case of mortgage refinancing, albeit this is not usually the case. As an alternative, you may receive a closing disclosure, about which you can read more below.

Special Considerations

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 requires all lenders to provide a Closing Disclosure form to borrowers of conventional mortgages, jumbo mortgages, and jumbo reverse mortgages.

Conclusion

When financing a home purchase using borrowed funds, the HUD-1 form must be completed. Other frequent names for this document include "Settlement Statement," "Closing Statement," "Settlement Sheet," "HUD," and variations thereof. You must carefully read your HUD-1 statement if you ever receive one. If possible, have a real estate lawyer review the contract to ensure you aren't spending too much or overlooking any faults that could increase your expenses. It's important to remember that you may have to make payments on this amount for many years to come, so the date you receive your HUD-1 might have a profound impact on your financial future.

Saving Money And Making A Budget For An Apartment

After an interminable amount of time spent looking, you've discovered the ideal place to call home. It's affordable, elegant, and has plenty of room to move around. But when the first month's invoices come in, you may be taken aback to see a higher total amount owed than you had anticipated. Costs beyond just rent include things like utilities and upkeep.

Nov 21, 2023 Susan Kelly

Top 6 Excellent Investment Courses That May Be Taken Online For Free

Vanguard provides age-appropriate investment education via its website. The Morningstar Investment Classroom offers in-depth, topic-specific lessons. NAPFA offers a monthly free webinar series covering tax preparation, investing and financial planning.

Feb 23, 2024 Triston Martin

Tax Benefits of the College Savings Iowa 529 Plan

Investors in the College Savings Iowa 529 can benefit from tax-deferred growth, tax-free withdrawals, and a state tax deduction.

Feb 22, 2024 Triston Martin

Highest Paying Positions At Major Banks

Working for large banks may lead to a prosperous and secure financial future. Many positions exist in the financial industry, each calling for a unique mix of knowledge and experience. Investment banking, wealth management, risk management, compliance officer, quantitative analysis, investment analyst, and credit analyst are just a few high-paying positions discussed in this article. These positions are vital to the bank's success and may lead to promising careers.

Nov 17, 2023 Triston Martin

Reasons a home buyer should ask for a loan condition

Provided something goes wrong during the loan approval or home inspection processes, the buyer will be able to cancel the purchase agreement if the contract contains a loan contingency clause. If a buyer is unsure if they will be able to secure a house loan, they should make sure a loan contingency, also known as a mortgage or financing contingency, is in their contract.

Dec 18, 2023 Susan Kelly

Top Peer to Peer Payment Apps

Because of the growing number of phones on the market today, peer-to-peer payments applications account for a significant portion of the digital payments industry. P2P applications, in their most basic form, allow for the frictionless movement of cash between two users. If you have ever divided a bill at a restaurant and paid the difference using a digital platform, you have certainly taken part in a peer-to-peer payment.

Dec 28, 2023 Triston Martin