You Must Understand How To Invest In Copper

Feb 02, 2024 By Triston Martin

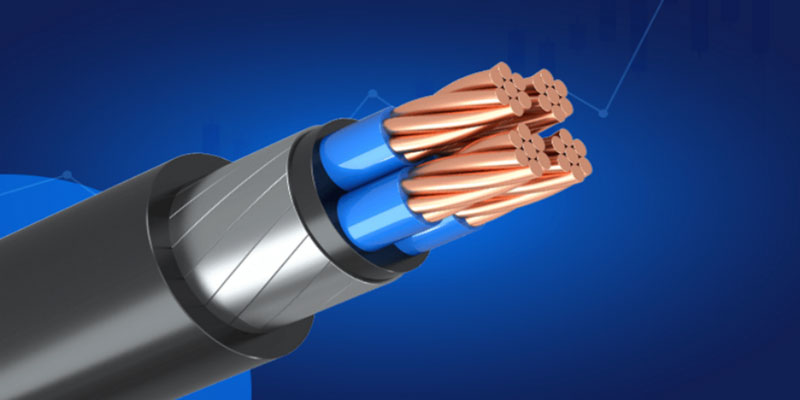

Copper investments may be made either immediately or indirectly. Copper may be invested in various ways, both physically and via derivatives such as futures, stocks, ETFs, and mutual funds. Investing isn't limited to the purchase and sale of supplies, ETFs, as well as bonds. Many financiers would instead put their money into commodities like metals than into paper securities. Copper is a widely-held commodity and a sought-after investment metal. The semiconductor and wire industries both rely heavily on copper for their operations. It's crucial to several fields, including building and manufacturing automobiles and houses. Copper's low price makes it attractive to traders and How To Invest In Copper who are wary of dealing in metals like silver and gold owing to their high pricing.

How To Invest In Copper In Three Easy Steps

It would be best if you took the following actions to begin investing in copper:

Determine Your Investment Strategy

Numerous entry points exist for prospective copper investors. While it is possible to buy copper physically, doing so presents several challenges related to transit and storage. Putting money into copper exchange-traded funds can be the most straightforward strategy. A simple approach for investors to go and get exposure to the copper market, these funds seek to track the performance of copper prices. Copper futures and options trading are two other avenues to explore.

Rather than dealing with copper itself, investors might benefit from their forecasts about how the price of copper will change. Investing in mining companies that harvest copper from the ground is a third option for gaining exposure to the metal. Investing in this corporation also involves a risk of loss, so it's not just like buying copper. Even if copper doesn't go well, you could come ahead if that firm does well. On the other hand, a mismanaged company's stock might decline in value regardless of the price of copper.

Create An Account

You should create a brokerage account after you've settled on a strategy for investing in copper. How you want to put your money to work in the market should influence your choice of broker. Most brokers will be able to help you invest in copper exchange-traded funds or mining firms. The use of derivatives requires the assistance of brokers specializing in these instruments. Be mindful of the costs associated with each broker when you make your decision. For your trading activities, the one with the lowest fees is the best option. Finding a seller is essential to get copper in its physical form. A strategy for storage is also required. Others choose to use massive storage facilities, while others opt for at-home storage of metals.

Submit A Buy Order

You may start purchasing copper as soon as you register an account. You may place a buy order for any stock, ETF, or derivative to increase your portfolio's copper exposure.

What You Should Know Before Investing In Copper

Understanding the elements that affect copper's value is crucial before investing in copper. In the long run, copper's value is determined mainly by supply and demand, as with almost every other commodity. When reserves are limited and demand is strong, prices rise, and when supplies are plentiful, and demand is low, prices fall. Corporations or governments sometimes hoard copper. This buffers them against price swings caused by fluctuations in supply and demand. Unlike gold and other precious metals, copper is mainly used in industrial applications. Consequently, industries like building and manufacturing, particularly electronics, are the primary drivers of copper demand. The demand for copper rises when economies are doing well, while the price of copper falls when countries are doing poorly. In addition to its rising usage in EVs and renewable energy, copper's price has risen due to recent environmental measures.

Conclusion

Because of a resurgence in its popularity among industrial users, the value of copper is expected to increase by a factor of five between 2001 and 2022. It's a multipurpose metal with broad applications in construction, electronics, electrical conductivity, transportation, and hygiene. It stands to gain from the current trend toward electric cars and renewable energy sources and from the improved infection control caused by the recent coronavirus epidemic. The Global X Copper Miners Exchange Traded Fund (COPX) represents copper equities, which have lagged the market recently. Comparatively, the S&P 500 index returned -10.7% over the previous 12 months, whereas COPX returned -15.5%. These are shares in copper mining firms instead of futures contracts on the metal itself.

The Chase Sapphire Reserve: Navigating the Annual Fee Landscape

Is the Chase Sapphire Reserve annual fee worth it? Discover if it is justified by exploring its perks, rewards, and robust security features.

Feb 06, 2024 Triston Martin

Unaffiliated Investments

Investments in assets that are not directly controlled by the insurance company or any other firms in which the insurance company has a majority ownership stake. Investments not associated with a company might take the form of stocks, mortgages, property, or other assets.

Nov 12, 2023 Triston Martin

Is It Reasonable To Have A Credit Score Of 766?

A person's credit score is a crucial indicator of their financial well-being. A person's creditworthiness is indicated by a three-digit number, often 300 to 850. A good credit score shows that a person is reliable with financial obligations and will repay loans and other commitments on time.

Feb 13, 2024 Triston Martin

Refinancing a VA Loan

You have two options for refinancing a VA loan: Lower the interest rate with a VA streamline refinance or extract equity with a cash-out refi.

Nov 12, 2023 Susan Kelly

You Must Understand How To Invest In Copper

Copper is considered one of the most valuable metals, and indeed the copper industry consists of businesses engaged in its discovery, extraction, development, and production. Copper's widespread usage in the building and remodeling industries and in consumer electronics, industrial equipment, transportation, and power production and transmission makes the metal's demand highly sensitive to economic fluctuations. Copper investors might choose from several different strategies. Copper bullion bars, including coins, copper futures, and exchange-traded funds (ETFs) that invest in copper and some other precious metals, including copper stocks, are all ways for investors to get their hands on the metal.

Feb 02, 2024 Triston Martin

Online Brokers for Free Stock Trading

Choosing the right online broker for free stock trading requires careful consideration of several factors. It's essential to review the charges, the trading platform, the security measures, and the investment options offered by the broker. By comparing your options and making an informed decision, you can find the right online broker to help you reach your investment goals

Oct 05, 2023 Triston Martin